The European Commission recently announced the initiation of a second anti-dumping and countervailing duty sunset review investigation into solar glass originating in China, following applications filed by Interfloat Group, i.e., Interfloat Corporation, and GMB Glasmanufaktur Brandenburg GmbH on April 18 and 19, 2025. The investigation will examine whether the damage caused by dumping and subsidies to the EU domestic industry by the products in question would continue or recur if the current anti-dumping and countervailing measures were lifted.

The EU CN code for the products in question is ex7007 19 80 (TARIC codes are 700719 80 12, 7007 19 80 18, 7007 19 80 80, and 7007 19 80 85). The sunset review investigation period runs from July 1, 2024, to June 30, 2025, and the industry injury investigation period runs from January 1, 2022, until the end of the investigation period. In fact, this same maneuver was repeated as early as 2013: first anti-dumping, then countervailing duties. The following year, anti-dumping duties of up to 70% and countervailing duties of around 15% were imposed on Chinese glass. In 2019, the first "sunset review" extended the duties for another five years. Now, with the duties set to expire in 2025, Germany's Interfloat has teamed up with two domestic manufacturers to file another appeal, leading to the current wave of double reviews.

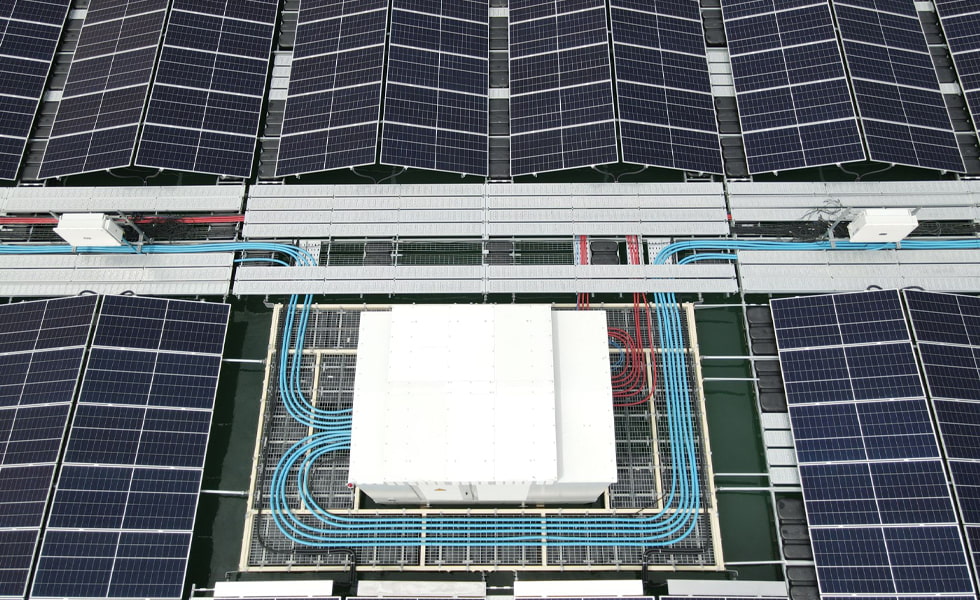

Essentially, this is the result of Europe's industrial hollowing out combined with EU "regional protectionism." According to EU data, while EU domestic photovoltaic installed capacity reached 56GW in 2023, Europe's total solar glass production capacity was less than 8GW. The remainder was imported, primarily from China.

Interfloat even stated, "If the government removes the tariffs, we won't survive more than two years." However, under these regional protectionist measures, while the German photovoltaic glass industry has survived, the costs will inevitably be passed directly on to downstream solar panel manufacturers. Meyer Burger, the leading European component manufacturer, also stated that the tax-inclusive price of glass is already 45% higher than that in Southeast Asia, and that its own components have repeatedly ranked last in European bidding documents.

The EU appears to have failed to implement concrete measures to fundamentally address the hollowing-out of its industries, instead repeatedly using hard-line policies to undermine the fairness of global trade. This was the case on April 25th of this year, when the EU announced anti-subsidy and anti-dumping rulings on mobile lifting platforms originating in China, imposing "double-antidumping" duties on such products imported from China.

According to the April tariff increase table, the combined punitive tariff rate for the two categories reached a maximum of 66.7% and a minimum of 20.6%.

However, these EU actions suggest that the imposition of anti-subsidy and anti-dumping duties on China is partly an attempt to further curry favor with the United States. This is because, just as Trump announced a temporary 10% base tariff increase on all economies except China, the EU suspended its retaliatory measures against the US tariffs, originally scheduled for April 15th, for 90 days.

The problem, however, is that these protectionist measures by the EU have backfired. For example, the EU attempted to buy time for the implementation of the Net Zero Industrial Act through "double-anti-dumping" measures, aiming to increase the share of domestic European PV supply chains to 40% by 2030.

However, the reality is that Europe's investment in the entire supply chain, including silicon materials, glass, frames, and inverters, is significantly lagging behind. According to incomplete statistics, the financing for new glass furnace projects announced by the EU in the past 18 months is less than one-third of the capital expenditure of a leading Chinese company in half a year.

This decision has proven to not only increase costs for downstream component manufacturers but also exacerbate Sino-EU trade tensions.

The Trade Remedy Bureau of China's Ministry of Commerce responded swiftly, sternly stating that it will take all necessary measures to defend the legitimate rights and interests of Chinese companies. Industry insiders also warned that if the European Commission ultimately decides to extend the tariff order, China may take retaliatory measures, including restrictions on imports of polysilicon, silicon wafers, and even high-end alcoholic beverages into Europe.

If the game of supply chain bottlenecks escalates, European consumers will inevitably be the ultimate victims. For example, the payback period of rooftop photovoltaic systems may be extended from 7 years to 10 years, which will undoubtedly have a negative impact on Europe's green transformation process.